When you have poor credit, next looking for a loan of any sort will be tough. But not, although it shall be frustrating so you’re able to secure that loan which have bad borrowing, it’s possible.

One method to alter your odds of being approved toward mortgage you prefer is always to promote security to your loan. Guarantee has been around for as long as people have already been financing currency to other some one.

More conventional different security are your property or auto. Basically, lenders take on cars just like the guarantee on condition that you have a substantial level of guarantee on your automobile. not, you happen to be capable of getting accepted to possess an unsecured loan giving equity in other means.

Taking a collateral Financing that have Less than perfect credit

Whilst you may an unsecured unsecured loan instead collateral, some think it’s better to get approved which have less than perfect credit for individuals who render collateral. You may score a diminished rate of interest that have security, however it usually however apt to be higher than should you have a or advanced credit.

When you yourself have felt like one to bringing security is best path for your requirements, you have got possibilities. You should use your vehicle, bank account, otherwise Video game for many secured loans. The needs to own guarantee are different according to the lender and your specific condition.

step one. OneMain Economic

As the 1912, OneMain Economic has been delivering bad credit unsecured loans. Mortgage numbers are normally taken for $step 1,five-hundred and you may $twenty-five,100000 which have a frequent Annual percentage rate start around % and %

OneMain discusses your credit score. Yet not, he or she is keen on the latest security you could potentially developed to own secured personal loans. With OneMain, you need to use an automobile, vehicle, rv, Camper, otherwise bicycle as the equity for the protected mortgage.

OneMain needs that head to an actual physical branch to talk about the mortgage choice which have a professional and entice specific records. After that, when they finance the loan, there will be various percentage options to build your lifetime easier, along with due to an application, from send, in the an actual physical branch, and many Walmart metropolises.

2. Wells Fargo

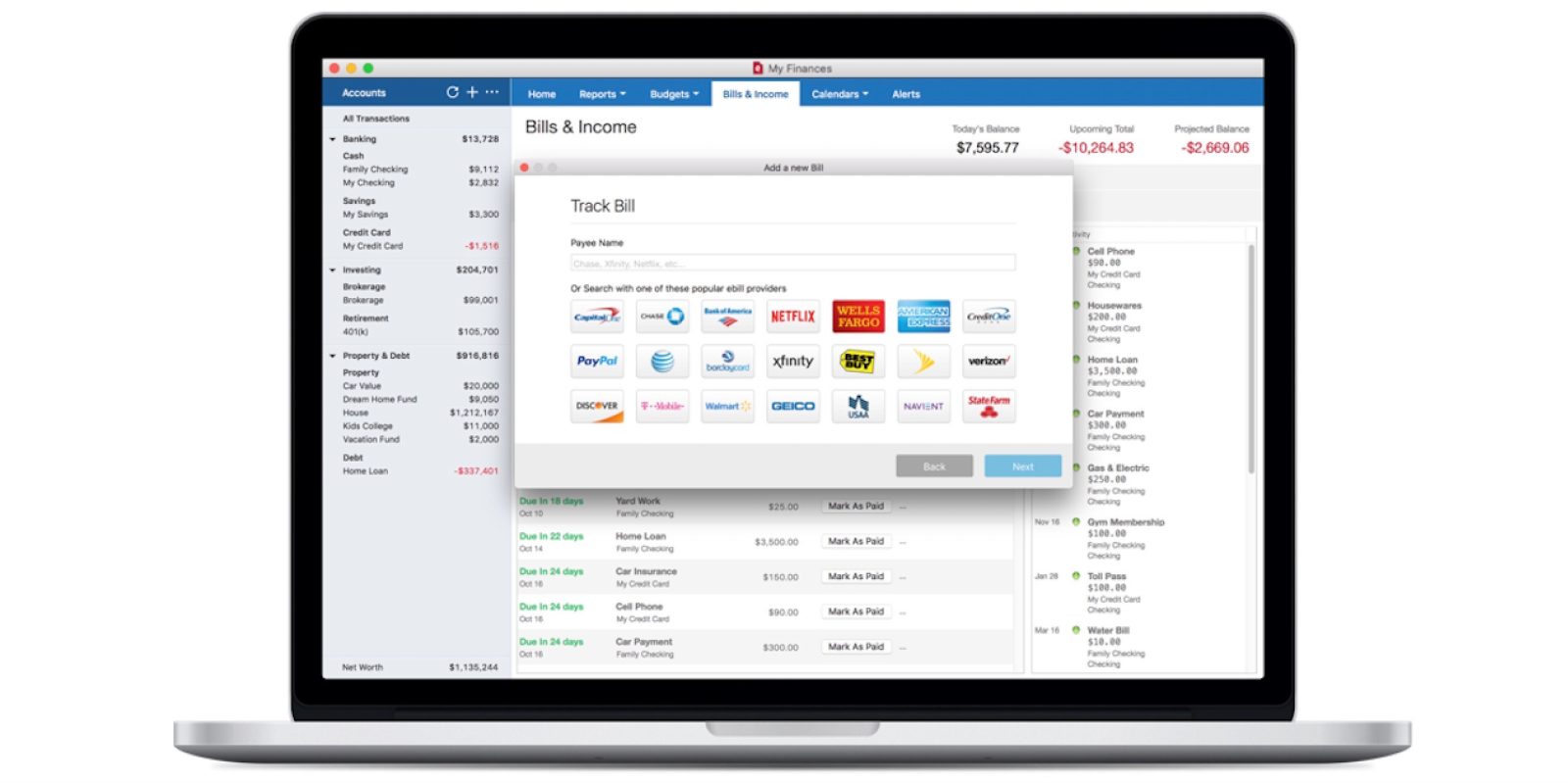

Wells Fargo are a mainstay throughout the American banking industry. For those who currently have a family savings or Computer game account stored in the Wells Fargo, you might have the ability to safe your very own financing with possibly of these accounts.

Which have Wells Fargo, you happen to be capable reduce your Annual percentage rate getting a secured consumer loan for  many who arranged your own Wells Fargo bank account otherwise Cd while the security. Even though the security doesn’t always replace your probability of being acknowledged with the covered mortgage, it can get you top mortgage words and you can increased mortgage count.

many who arranged your own Wells Fargo bank account otherwise Cd while the security. Even though the security doesn’t always replace your probability of being acknowledged with the covered mortgage, it can get you top mortgage words and you can increased mortgage count.

Use your Vehicles given that Collateral for a financial loan

When you yourself have a vehicle on hand, then you’ve a different way to safe financing. In lieu of getting a protected personal loan, you might apply for a funds-away refinancing or vehicles security credit line for your vehicle.

Which have an earnings-out re-finance, you could re-finance the car finance for over you borrowed with the auto. However, you cannot obtain a loan for more than the complete equity you have throughout the vehicle. Such as for instance, if you owe $5,one hundred thousand towards an automobile worthy of $15,000, then you can manage to bucks-out re-finance for $10,100000 which have certain loan providers.

Typically, lenders require that your particular auto is within good condition that have an excellent restricted level of miles to help you be eligible for such protected mortgage. Also, you’ll need to possess some date left in your latest auto mortgage.

Here are particular on the internet lenders that can be in a position to works along with your less than perfect credit when you have a car or truck as equity.